Since darkish pool individuals don’t disclose their trading intention to the trade before execution, there is no order e-book visible to the basic public. Trade execution details are only launched to the consolidated tape after a delay. Dark swimming pools are typically solid in an unfavorable mild however they serve a purpose by allowing large trades to proceed without affecting the wider market. However, their lack of transparency makes them vulnerable to potential conflicts of curiosity by their house owners and predatory buying and selling practices by some high-frequency traders. While they could benefit the overall market, the advantages do not outweigh the potential problems.

Transaction via a stock change cannot be conducted in a means that retains the investor’s identification or purposes discrete. Dark Pools provide a extra personal and less volatile buying and selling setting, as orders are matched anonymously and executed outdoors of public exchanges. These strategies usually involve shopping for securities in the dark pool at a lower cost than the public market after which selling them on the basic public market at the next worth, cashing in on the difference. Dark pools provide increased anonymity for buyers, which may be notably useful for big institutional buyers who do not want to reveal their trading strategies or tip their hand to other market members.

Darkish Pool Liquidity Looking For Strategies

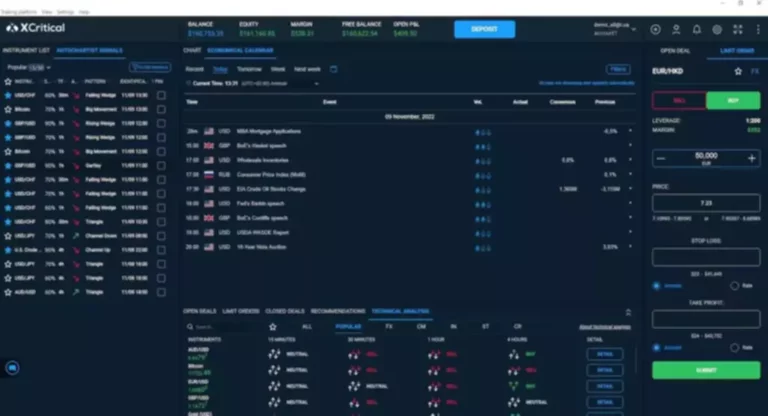

Dark pools are digital non-public markets where institutional traders such as pension funds, mutual funds, banks, corporations, sovereign wealth, hedge, and private fairness funds trade. Dark Pools work by matching buyers and sellers anonymously and executing trades outdoors of public exchanges. The SEC requires dark pools to register as various trading methods (ATSs) and adjust to a range of rules designed to guard buyers and ensure market integrity. Since the details of the trades aren’t out there to the common public, it can be challenging to evaluate the impression of dark pool buying and selling on the broader market.

HFT controversy has drawn growing regulatory attention to darkish swimming pools, and implementation of the proposed “trade-at” rule could pose a risk to their long-term viability. Fortunately, there’s a method you can retain the anonymity of your trades legally (up to a sure extent). It may sound like a conspiracy theory, but several authorized opaque institutional buying and selling markets are allowed to hide quotes and report orders solely after being executed.

Definition And Examples Of Darkish Pools

Many merchants blamed brokers for colluding against retail investors and using them to artificially control stock prices. The initial drawback that dark pools solved is pretty easy to understand—institutions wanting to trade large blocks of shares with out worrying about front-running or price of execution. By shielding their strikes from the border market, they’ll get a better deal. In fact, many dark pools are created by brokers who use them to handle their inner order circulate more effectively, but they aren’t the one ones to run private exchanges.

However, according to the CFA Institute, non-exchange buying and selling has lately grown in recognition within the United States. A privately organized monetary trade or hub where securities, derivatives, and other monetary belongings are traded. These strategies sometimes contain utilizing algorithms to seek out the most environment friendly way to execute a commerce what is a dark pool whereas minimizing the influence in the marketplace. When an institutional investor wants to shift property, it risks creating a value swing due to different buyers who see the curiosity or disinterest and react accordingly. Due to an unprecedented surge in buying and selling quantity for meme shares, Robinhood had shut down buying and selling for these specific shares.

What Are Dark Pools In Cryptocurrency?

By matching patrons and sellers privately and executing the commerce outdoors the public market, darkish swimming pools stop other market participants from reacting to the commerce and driving up or down the price. Dark lit swimming pools are typically utilized by institutional buyers who must trade giant blocks of securities and need to decrease market impression and maximize anonymity. Dark pools, in any other case generally recognized as Alternative Trading Systems (ATS), are legal non-public securities marketplaces. In a dark pool buying and selling system, buyers place buy and promote orders without disclosing either the worth of their trade or the number of shares. The common commerce dimension in darkish swimming pools has declined to lower than a hundred and fifty shares. Contrast this with the present-day scenario, where an institutional investor can use a darkish pool to promote a block of 1 million shares.

After the brief squeeze in 2021, the darkish pool debate was ignited once more as retail merchants started wisening as a lot as shady ways used by the massive players available within the market. Dark swimming pools stay authorized and regulated by the SEC regardless of the issues over them rising over the earlier few years. They are probably permitted to function as a outcome of they also offer a number of benefits to the market.

By buying and selling anonymously, investors can avoid being focused by high-frequency merchants or other investors who might search to use their trading exercise. When an investor needs to buy or sell securities, they submit an order to the dark pool, specifying the amount and the value they are keen to pay or obtain. Working with an adviser might come with potential downsides such as payment of fees (which will cut back returns). There are not any ensures that working with an adviser will yield positive returns. The existence of a fiduciary duty doesn’t stop the rise of potential conflicts of curiosity. SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

SoFi doesn’t assure or endorse the merchandise, info or suggestions supplied in any third get together website. Additionally, front-running retail orders solely turn out to be a difficulty when it’s systematic as market makers achieve an advantage by method of data. Yet the average particular person investor should not be massively involved about front-running on single orders. Many accused personal equity markets of enabling high-frequency buying and selling (HFT) to run amok on their markets, resulting in systematic problems for the border market, which led to the market crashing extraordinarily rapidly. All evaluations, analysis, news and assessments of any type on The Tokenist are compiled utilizing a strict editorial review process by our editorial staff.

The fragmentation of digital buying and selling platforms has allowed darkish pools to be created, and they’re normally accessed by way of crossing networks or instantly among market members through personal contractual arrangements. Generally, dark swimming pools aren’t obtainable to the general public, however in some cases, they may be accessed indirectly by retail buyers and merchants via retail brokers. The main advantage of dark pool buying and selling is that institutional traders making massive trades can accomplish that with out exposure whereas discovering buyers and sellers.

Darkish Pool Advantages

A surprisingly massive proportion of broker-dealer darkish pool trades are executed inside the pools–a course of that is identified as internalization, even when the broker-dealer has a small share of the us market. The darkish pool’s opaqueness also can give rise to conflicts of curiosity if a broker-dealer’s proprietary merchants commerce towards pool shoppers or if the broker-dealer sells particular entry to the dark pool to HFT companies. The biggest advantage of dark swimming pools is that market impact is considerably lowered for large orders. Dark pools may also lower transaction costs as a end result of dark pool trades do not have to pay trade charges, while transactions based mostly on the bid-ask midpoint don’t incur the complete unfold. Dark pools are personal exchanges for trading securities that are not accessible to the investing public.

Dark pool informational methods are designed to benefit from the knowledge asymmetry that exists in the lifeless of night pool. Additionally, some critics argue that the shortage of transparency can create opportunities for insider trading or different forms of market manipulation. Yet as the corporate begins to purchase all of its personal shares off the market, the worth will spiral, pushing expenses, and doubtlessly debt, greater. SoFi has no management over the content, products or services supplied nor the safety or privacy of knowledge transmitted to others through their website. We advocate that you evaluation the privateness policy of the positioning you’re coming into.

Chiefly, darkish swimming pools exist for big scale buyers that don’t want to affect the market by way of their trades. The influence they may doubtlessly have on the market is often generally recognized as the Icahn Lift, named after legendary investor Carl Icahn. The story goes that Icahn can influence the price of a stock simply by purchasing it. The “lift” comes when other buyers see Icahn’s curiosity and jump in, causing the stock price to rise. As many may surmise, lit pools are successfully the alternative of dark swimming pools, in that they present buying and selling data similar to variety of shares traded and bid/ask prices.

As costs are derived from exchanges–such as the midpoint of the National Best Bid and Offer (NBBO), there isn’t any worth discovery. According to the CFA Institute, non-exchange trading has recently turn out to be more in style in the us Estimates present that it accounted for approximately 40% of all U.S. stock trades in 2017 in contrast with roughly 16% in 2010. The CFA additionally estimates that dark pools are answerable for 15% of U.S. volume as of 2014. For instance, let’s say you all of a sudden need to pull an Elon and purchase a billion dollars price of Twitter shares (before he determined to buy the entire company).

These “alternative buying and selling systems” that hide commerce quotes are generally identified as dark swimming pools. If you have a connection to an institutional investor—such as owning a pension fund or investing in mutual funds—dark pools can make an influence on you personally. A broker might be succesful of help these institutional traders acquire better pricing by way of a darkish pool quite than paying the publicly listed worth on a lit trade. This can imply higher returns for these institutional funds, which might trickle down to the returns you see.

Dark pools present access to liquidity for traders who need to trade large blocks of securities that is probably not obtainable on the public market. By matching buyers and sellers privately, darkish pools can provide entry to liquidity that may not be seen to the broader market. Dark swimming pools present pricing and value https://www.xcritical.com/ advantages to buy-side establishments such as mutual funds and pension funds, which maintain that these benefits finally accrue to the retail buyers who own these funds. However, darkish pools’ lack of transparency makes them vulnerable to conflicts of curiosity by their homeowners and predatory trading practices by HFT corporations.